Linea price has plunged over 90% after a chaotic airdrop rollout.

Community backlash grew after Binance users claimed tokens first.

Ecosystem shows Linea has hit a $2.5B TVL despite tokenomics and governance concerns.

Linea’s much-hyped token launch has turned chaotic, with the LINEA price collapsing more than 90% within hours of its debut despite high-profile listings on Binance, Bybit, and OKX.

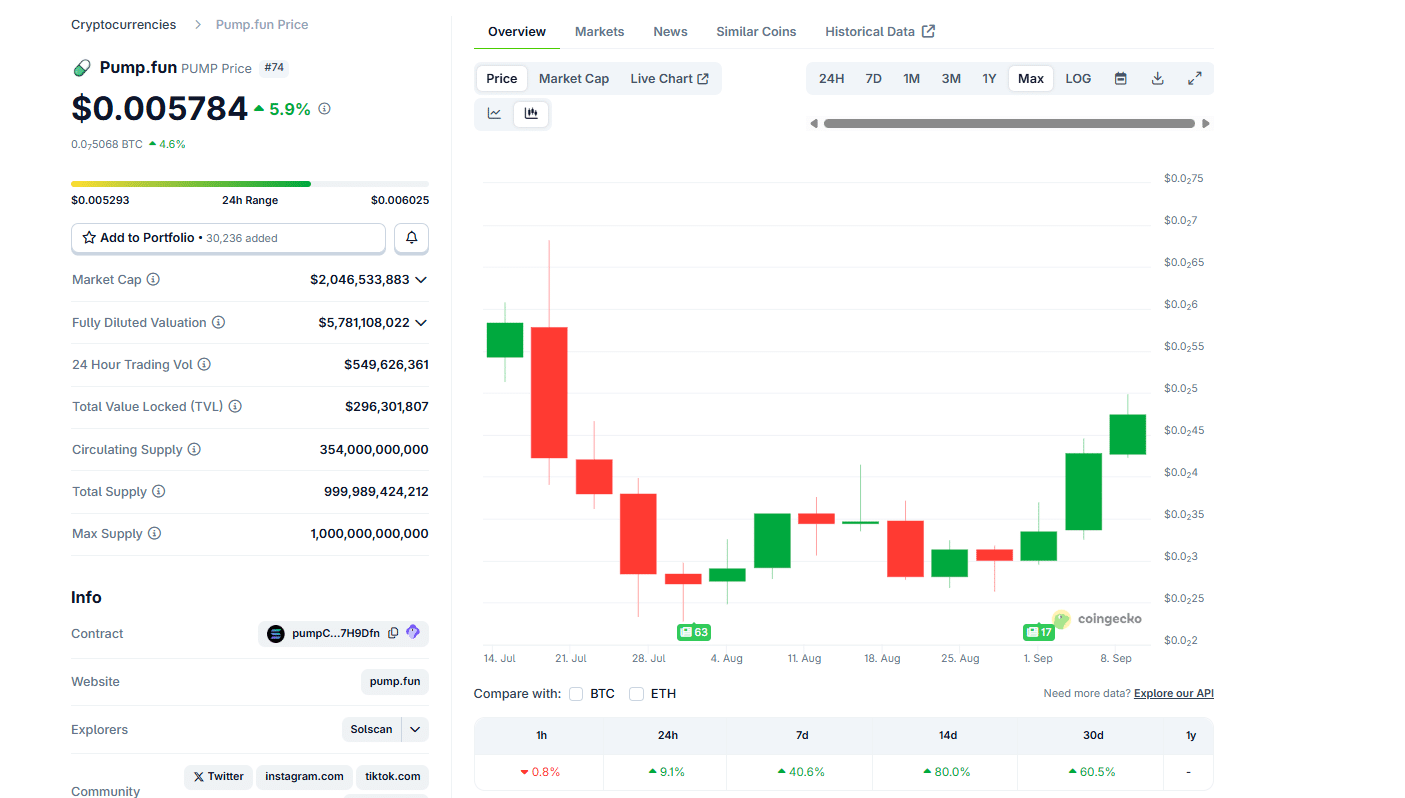

The token, part of ConsenSys’ zkEVM Layer 2 network, surged briefly on September 9 from $0.030 to as high as $0.046 after its exchange listings.

However, heavy profit-taking and a chaotic token airdrop process triggered a wave of selling that erased most of the early gains.

Linea’s token airdrop

Linea’s token went live on September 9 through what the project described as one of Ethereum’s largest community airdrops in years.

Roughly 9.36 billion tokens were distributed across about 749,000 eligible wallets, part of a wider allocation that placed 22% of the total supply in circulation at launch.

In an unusual approach, the distribution excluded venture capital firms, team members, and advisors, positioning itself as a community-first experiment.

The launch, however, did not unfold smoothly. Network congestion created long waits and higher fees for users claiming tokens.

To complicate matters further, Linea’s mainnet sequencer briefly halted block production just before the token generation event, stoking frustration.

Although the issue was resolved within an hour, the delay has already fueled perceptions of a bungled rollout at a critical moment.

Binance listing-driven spike faded fast

The project enjoyed immediate exposure on Binance, Bybit, OKX, Bitget, and other top platforms, helping the LINEA token price rally from its launch price of $0.030 to an all-time high of $0.046.

However, the gains evaporated within hours, and by the evening of September 10, LINEA had collapsed to $0.023, wiping out nearly half its value.

Some data points show the drop was even more severe on certain exchanges.

On OKX, for example, the auction-based launch initially steadied price discovery around $0.03, only for a flood of sell orders to overwhelm liquidity and drive the token as low as $0.024, a massive fall from a reported peak near $0.32.

The controversy surrounding the Linea airdrop

Beyond profit-taking, the airdrop process itself drew sharp criticism.

Community members reported delays in claiming their allocations, while Binance users appeared to receive tokens instantly.

Blockchain analysts later confirmed that the contract funding the community airdrop was deployed roughly 50 minutes late, giving exchange-linked recipients an advantage.

The $LINEA tokens were sent to the claim contract 50 minutes late for airdrop users, while Binance users were already claiming and dumping instantly.

Tx: https://t.co/N52Vpyxk5M@DeclanFox14 @Alain_Ncls

Why was the community airdrop delayed 50 minutes without any announcement? pic.twitter.com/nXmQHqtDgA

— Zack (@0xZackHQ) September 10, 2025

In addition, critics labelled the event as favouring centralised players in what was meant to be a decentralised distribution.

Today $Linea dropped an airdrop for the community…But at TGE — no one could even claim their tokens.

Meanwhile, Binance users got theirs instantly.

This is not just a glitch — it’s how projects farm hype, extract attention, and then sideline the real community.

🚨 Time to… pic.twitter.com/Do04C3yF32

— rowdy.eth🇮🇳 (@rcboyxeth) September 10, 2025

The perception of unfairness coincided with immediate selling pressure from those who secured allocations early.

With more than 15 billion tokens unlocked on day one, Linea’s circulating supply represented over 21% of its total issuance, a ratio considered unusually high for a new token.

This only intensified fears of inflation and short-term dumping.

Linea’s tokenomics fuel debate

Linea has attempted to distinguish itself through what it calls deflationary tokenomics.

A dual-burn model sends 20% of net Layer 2 fees to be destroyed as ETH, while the remaining 80% is used to buy LINEA from the open market and burn it.

The system is designed to create consistent buy pressure, setting it apart from rivals such as Arbitrum and Optimism.

However, Linea lacks a decentralised governance structure.

While 85% of the total supply has been earmarked for ecosystem growth, decision-making remains concentrated, leaving unanswered questions about transparency and long-term control.

LINEA price outlook

Despite the price collapse, Linea’s ecosystem metrics remain robust.

Its total value locked has surged to $2.984 billion according to data from DeFiLlama, with Aave alone holding more than $776 million on the network.

Daily active addresses average nearly 50,000, while decentralised exchange volumes recently surpassed $215 million in a single day.

But whether those fundamentals can support a price rebound remains unclear.

Eyes are on the $0.024 support level, with speculations that the selloff may have flushed out short-term holders, paving the way for a more stable market, although the scheduled token distributions, including the upcoming Linea Ignition program, could trigger another wave of declines.