Bitcoin is seeing some relief after dipping below the $110,000 mark earlier this week, but risks remain firmly on the horizon. While the rebound has sparked cautious optimism among traders, many analysts warn that BTC could continue to lose momentum if selling pressure persists. The broader market has entered a fragile phase where investor sentiment is mixed, and short-term direction remains uncertain.

Top analyst Darkfost highlights a critical on-chain development: the number of transactions coming from wholecoiners—investors holding at least one full BTC—has dropped to its lowest level of the current cycle. This cohort has long been viewed as a significant gauge of market conviction, given the symbolic and economic weight of holding a full Bitcoin.

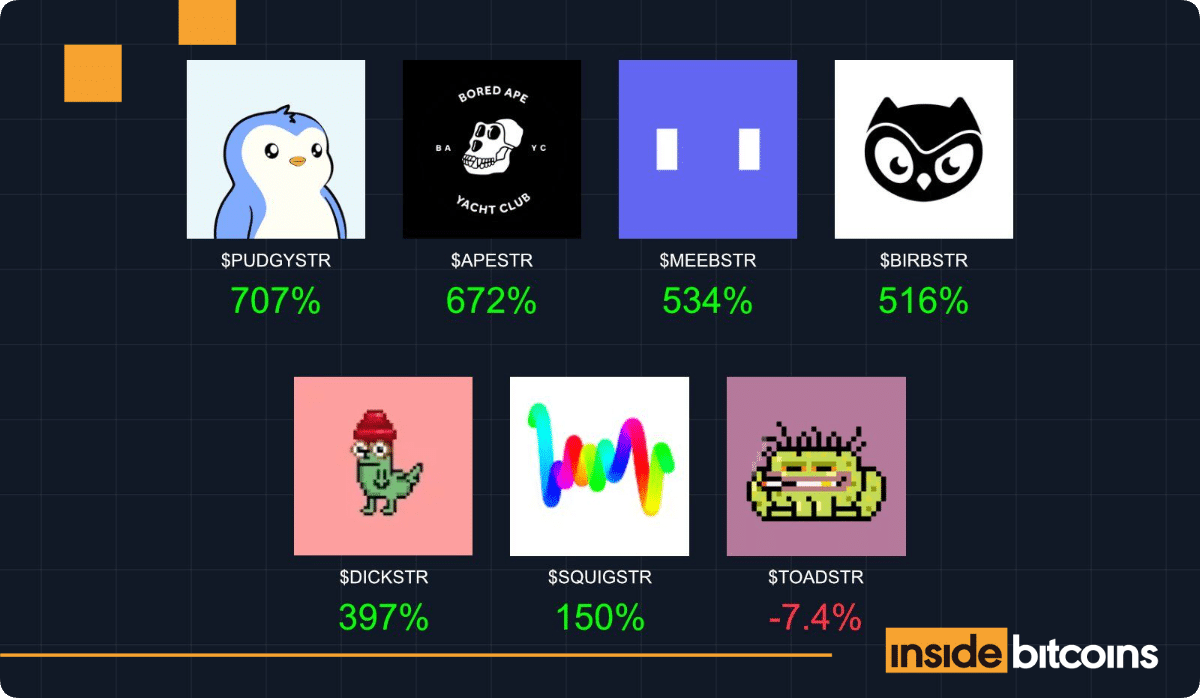

On Binance, wholecoiner inflows have sharply declined, falling from a peak of nearly 11,500 BTC in November 2023 to around 7,000 BTC today. The same trend is visible across all major exchanges, where average annual deposits from wholecoiners have dropped from 45,000 BTC in May 2024 to about 30,000 BTC now. This decline underscores weakening activity among long-term investors and adds to the uncertainty facing Bitcoin. With supply tightening and conviction tested, the coming days could prove pivotal for BTC’s next move.

A Unique Signal For Bitcoin Market Psychology

Darkfost explains that the behavior of wholecoiners is a unique and highly valuable indicator for understanding Bitcoin’s market psychology. Unlike short-term traders, this group represents investors who have managed to accumulate at least one full Bitcoin, a feat that has become increasingly challenging as BTC’s price has risen over the years. Holding one full coin carries both symbolic and economic weight, making wholecoiners a class of investors worth monitoring closely.

An increase in their exchange inflows often signals a shift in conviction. It can suggest that these investors are more willing to take profits or reduce exposure during uncertain market conditions, adding potential selling pressure. On the other hand, when deposits from wholecoiners decline, it typically reflects stronger conviction to hold. This mechanical reduction in supply available on exchanges helps to ease selling pressure and can create a more stable environment for BTC.

This dynamic ties directly to Bitcoin’s scarcity effect. As adoption grows and the supply becomes more distributed, the total number of wholecoiners tends to stabilize or even decline. Each whole Bitcoin becomes increasingly rare to acquire, further magnifying the influence and symbolic importance of this group. For analysts, tracking wholecoiner flows provides an essential lens into the conviction and sentiment driving long-term market trends.

Holding Above $112K, But Resistance Looms

Bitcoin is currently trading around $112,242, showing a slight recovery after testing the $110K support zone earlier this week. The chart reveals that BTC has managed to bounce off its recent lows, indicating short-term resilience. However, momentum remains capped by resistance levels overhead.

The 50-day moving average (blue line) is trending near $114K, aligning as immediate resistance. This suggests that bulls will need strong buying pressure to reclaim higher levels. Beyond that, the key hurdle sits around $123,217, the recent peak marked in mid-August. A breakout above this level would likely confirm bullish continuation and could open the door toward retesting $125K–$127K levels.

On the downside, the 100-day moving average (green line) near $111K is providing a cushion. A failure to hold above this level would expose BTC to deeper corrections, with the 200-day moving average (red line) around $104K acting as the next significant support.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.