Just as Amazon laid the rails for the digital economy, Metaplanet president Simon Gerovich says his company is building the new financial infrastructure. And he argues that the market often misprices companies in periods of structural change, obsessing over price while missing the power beneath the hood.

Like Jeff Bezos’ famous remark during Amazon’s dot-com crash, “The stock is not the company, and the company is not the stock,” Gerovich frames Metaplanet as a case study in misunderstood value, with hard numbers and historical perspective to reinforce his case.

Metaplanet fundamentals stronger than ever

To say Metaplanet’s performance this year is impressive would be an understatement of epic proportions. Q3 Bitcoin income revenue soared to ¥2.44 billion, up 115.7% quarter-over-quarter. Operating profit smashed forecasts by 88%, and of all public companies globally, only three now hold more Bitcoin.

Metaplanet now owns over 30,000 BTC, currently valued at approximately $3.7 billion. The balance sheet is pristine, with leverage under 1%, a rarity among crypto-heavy firms.

Short-term price pain is undeniable: Metaplanet’s stock has slid, a blow for team morale and for investors. But as with Amazon in the early 2000s, share price and company value can remain out of sync for extended periods.

Is the Amazon parable plausible?

Critics called Gerovich’s comparison to Amazon “ridiculous,” yet he remained undaunted. Early Amazon skeptics saw a glorified online bookstore, missing the multitrillion-dollar rails being laid for the entire digital economy.

Today, he argues, Metaplanet isn’t just a “Bitcoin holding company.” It’s building financial infrastructure for a new monetary epoch, with total addressable market (TAM) measured in the hundreds of trillions (the current valuation of fiat monetary assets globally).

A model as old as banking, as lean as a startup

Metaplanet’s business is nothing new: net interest margin. Banks borrow at one rate, lend at a higher one, and pocket the difference. The crucial twist is that Metaplanet’s spread is generated by holding Bitcoin as a reserve asset, funded with nearly costless yen.

Japanese households and businesses currently hold over $10 trillion in idle yen, earning near-zero interest, the raw material for Metaplanet’s higher-yielding model.

Metaplanet doesn’t have the big overheads and bureaucracy of traditional banks. Investors who buy its stock already benefit from its Bitcoin-focused strategy. The company is also looking at ways to offer reliable, higher-yield options for people in Japan who want better returns; ideas that could expand worldwide.

The big picture: Bitcoin as pristine collateral

Metaplanet’s bet is simple yet ambitious: Bitcoin is becoming the world’s hardest collateral. The migration of investors, from JPY earners to global USD pools, will seek yield, safety, and return, and Metaplanet is building the bridge to facilitate that shift.

There is more than $100 trillion sitting in global savings and banking accounts, earning less than inflation. If Bitcoin becomes more widely accepted, as Metaplanet believes, even a small portion of that money moving into Bitcoin could dramatically change the company’s growth and value.

Great companies often look most undervalued just as their moat deepens and the market can’t see over the near-term horizon. Metaplanet’s thesis is that the Bitcoin balance sheet isn’t a gimmick, but the linchpin for a $100 trillion+ yield opportunity. As Gerovich states:

“This is not small vision. It is one of the largest opportunities in global markets. If you don’t yet see it, that’s understandable—most didn’t see Amazon either.”

The market might not “get it” yet, but history shows the fundamentals should eventually force a repricing. And just like Amazon, building something new often means waiting for the market to catch up.

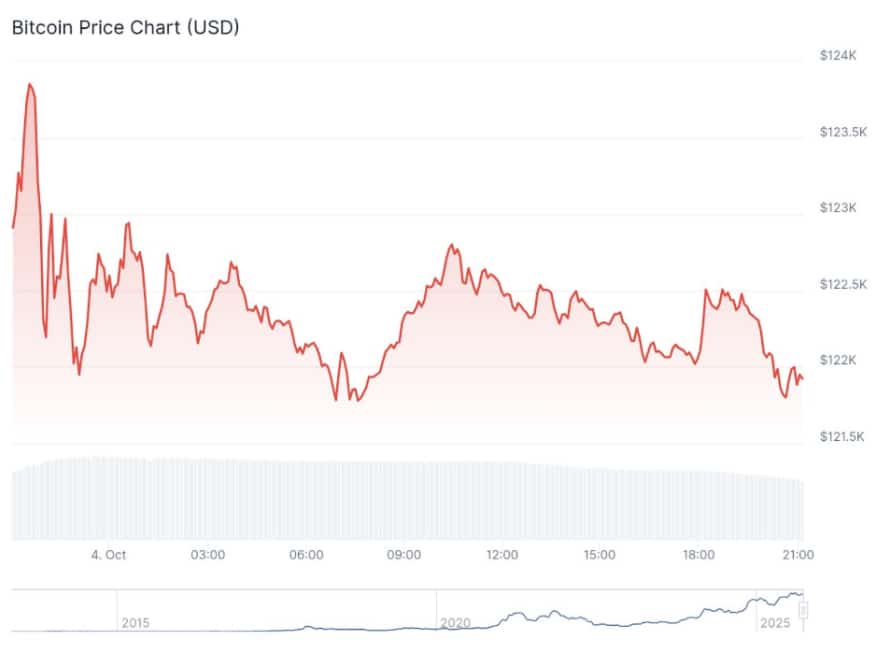

At the time of press 12:02 pm UTC on Oct. 4, 2025, Bitcoin is ranked #1 by market cap and the price is up 1.35% over the past 24 hours. Bitcoin has a market capitalization of $2.43 trillion with a 24-hour trading volume of $74.41 billion. Learn more about Bitcoin ›

At the time of press 12:02 pm UTC on Oct. 4, 2025, the total crypto market is valued at at $4.17 trillion with a 24-hour volume of $195.52 billion. Bitcoin dominance is currently at 58.36%. Learn more about the crypto market ›

Mentioned in this article