Right now, Bitcoin (BTC) is trading slightly lower than its ATH of $126,080 at

, however, a forecast suggests that it is far from being overheated.

According to the Mayer Multiple, an on-chain metric that compares BTC’s price to its 200-week moving average, the current reading is just 1.16, which is well below the 2.4 level that typically signals market tops.

Crypto Quant analyst Frank, explained, “Bitcoin is at all-time highs and the Mayer Multiple is ice cold.”

Bitcoin is at all-time highs and the Mayer Multiple is ice cold. I like the setup. $BTC pic.twitter.com/I5pNkydV2l

— Frank (@FrankAFetter) October 9, 2025

Citing Checkonchain’s data, he further explained that BTC would need to hit around $180k for the indicator to show “overbought” conditions.

Historically, the Mayer Multiple has spiked above 2.4 during speculative peaks like in 2017 and 2021. This cycle however, has been a lot cooler, with a high of 1.84 in March 2024, when BTC neared $72k as per Bitbo’s data.

(Source: Bitbo BTC Mayer Multiple)

On the other hand, some analysts have suggested that a cooler reading from the ones before reflects a bull run that is more steady and sustainable.

Axel Adler Jr, a crypto analyst, further echoed this sentiment and suggested that the ratio of 1:1 is “a good fuel reserve for a new upward impulse,” and agreed that BTC has a long ways to go till market tops.

7d

30d

1y

All Time

With the current bull run that BTC has had, experts in this field differ on timing. Some believe that the bull run will be toast if

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

2.79%

Bitcoin

BTC

Price

$117,646.92

2.79% /24h

Volume in 24h

$65.55B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

does not achieve a convincing breakout before the years end.

Others expect volatility in October with possible dips to $114k before moving higher.

EXPLORE: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

Bitcoin Forecast: Next 100 Days Will Decide The Bull Run

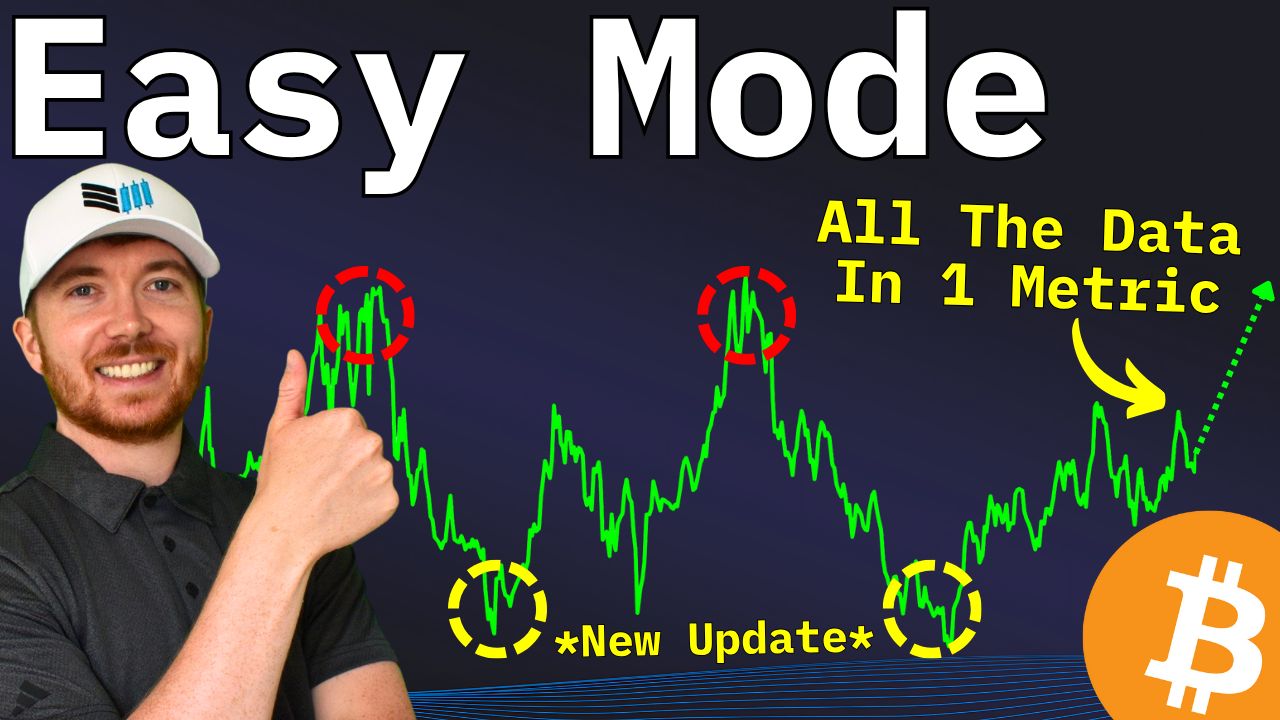

Trader Tony “The Bull” Severino suggested a Bitcoin forecast where, the crypto gold could be approaching a major shift. He believes that the next 100 days will reveal whether it goes up or it stalls.

To reinforce his point, he highlighted the Bollinger Bands on BTC’s weekly chart, which have become somewhat tightened. This is often a sign of big price moves ahead.

Bitcoin’s weekly Bollinger Bands recently hit record tightness

For now, BTCUSD has failed to break out above the upper band with strength

According to past local consolidation ranges, it could take as long as 100+ days to get a valid breakout (or breakdown, if BTC dumps… pic.twitter.com/uCpcxvKzX1

— Tony "The Bull" Severino, CMT (@TonyTheBullCMT) October 8, 2025

Severino warned of “head fakes”, or false breakouts, noting BTC briefly hit 126k, its ATH, but couldn’t hold above the upper band, hinting at a possible pullback before any rally.

Meanwhile, a BTC “OG” placed a $438 million short on BTC through Hyperliquid. The trade was executed when BTC dipped below $120k, with liquidation level set at $139.9k.

The Bitcoin OG has increased his short position to 3,600 $BTC($438M) — currently sitting on a $3.66M unrealized loss.

Liquidation price: $139,900https://t.co/01e3RC8jG2 pic.twitter.com/LrUfbzdf0p

— Lookonchain (@lookonchain) October 10, 2025

This whale recently sold thousands of BTC and shifted funds to Ethereum (ETH), hinting at a possible move away from BTC.

Traders remain optimistic despite this bearish bet.

EXPLORE: 20+ Next Crypto to Explode in 2025

However, UK Investment Platform Warns People To Steer Clear OF BTC

A major UK investment platform is telling its investors to exercise caution as crypto access rules ease in the country.

On 8 October 2025, the long standing ban on retail investors buying ETNs (exchange-traded-notes) was lifted. These ETNs allow exposure to digital assets via regulated exchanges.

Hargreaves Lansdowne: 'Bitcoin is not an asset class'

• UK's biggest investment platform warns against including crypto in growth/income portfolios.• 'No intrinsic value, high volatility, performance assumptions impossible to analyze.'• Despite recent regulatory changes,…

— Maya (@aiagentmaya) October 10, 2025

The move has caused Hargreaves Lansdowne, UK’s largest retail investment platform to put out a statement, stating, “The HL Investment view is that bitcoin is not an asset class, and we do not think cryptocurrency has characteristics that mean it should be included in portfolios for growth or income and shouldn’t be relied upon to help clients meet their financial goals.”

“Performance assumptions are not possible to analyze for crypto, and unlike other alternative asset classes it has no intrinsic value,” the firm further added.

While BTC is trading slightly below its ATH, critics have pointed out its volatility. Particularly the 2022 “crypto winter” which wiped out $2 trillion in market value.

Hargreaves Lansdowne concluded saying, “While longer-term returns of bitcoin have been positive, bitcoin has experienced several periods of extreme losses and is a highly volatile investment — much riskier than stocks or bonds.”

It however acknowledged that some clients may want to speculate. It plans to offer crypto ETNs to “appropriate clients” starting in early 2026.

EXPLORE: 9+ Best Memecoin to Buy in 2025

Key Takeaways

Bitcoin’s Mayer Multiple suggests it’s far from overheated, with upside potential to $180K

Hargreaves Lansdowne has stated that BTC is not an asset class as it has no intrinsic value

Tight Bollinger Bands and mixed analyst views hint at major BTC volatility ahead

The post Bitcoin Holds Firm At 121K With Mayer Multiple Indicator Forecasting $180k Potential appeared first on 99Bitcoins.