When Janet bought her first cryptocurrency, she did it on a whim. She’d often fraternized with the prospects of getting rich suddenly, having no worries and basking in the white sandy beaches of Zanzibar, whose pictures had often been spattered on the pages of travel magazines that she was so fond of. She’d often heard about the promise of getting rich through crypto, but she hadn’t the slightest clue what crypto was or how it worked. Her cousin had posted a screenshot of a $500 profit in just two days, and a YouTube influencer declared that this was the “next Bitcoin.” Jane didn’t know what a blockchain was, but she did know she didn’t want to miss out. So, with a fluttering heart and a shiny new Binance account, she put in $1,000—and waited.

Jane is not alone.

In the vast, wild world of crypto investing, stories like Jane’s are everywhere, woven into Twitter threads, Discord chats, and Reddit boards where novices become financial prophets overnight. But what few realize is that the crypto space, much like many high-risk environments, is a fertile ground for a particular kind of cognitive bias: the Dunning-Kruger Effect.

RELATED: Beginner’s Guide to Investing in Crypto

In late 2021, the launch of the SQUID token, named after the viral Netflix show Squid Game, offered a dramatic example of how the Dunning-Kruger Effect manifests in the world of crypto investing. Despite lacking official ties to Netflix and displaying obvious red flags like an anonymous team and a buy-only mechanism, the token soared over 75,000% in a matter of days.

Thousands of retail traders, driven by overconfidence, misinformation, and a poor grasp of blockchain fundamentals, eagerly poured in their funds, convinced they had found the next big opportunity. In the end, the developers executed a rug pull, disappearing with more than $3 million and leaving investors with worthless tokens. This incident vividly illustrates how cognitive bias and risk misjudgment can lead to catastrophic financial outcomes in an unregulated market.

Understanding the Dunning-Kruger Effect

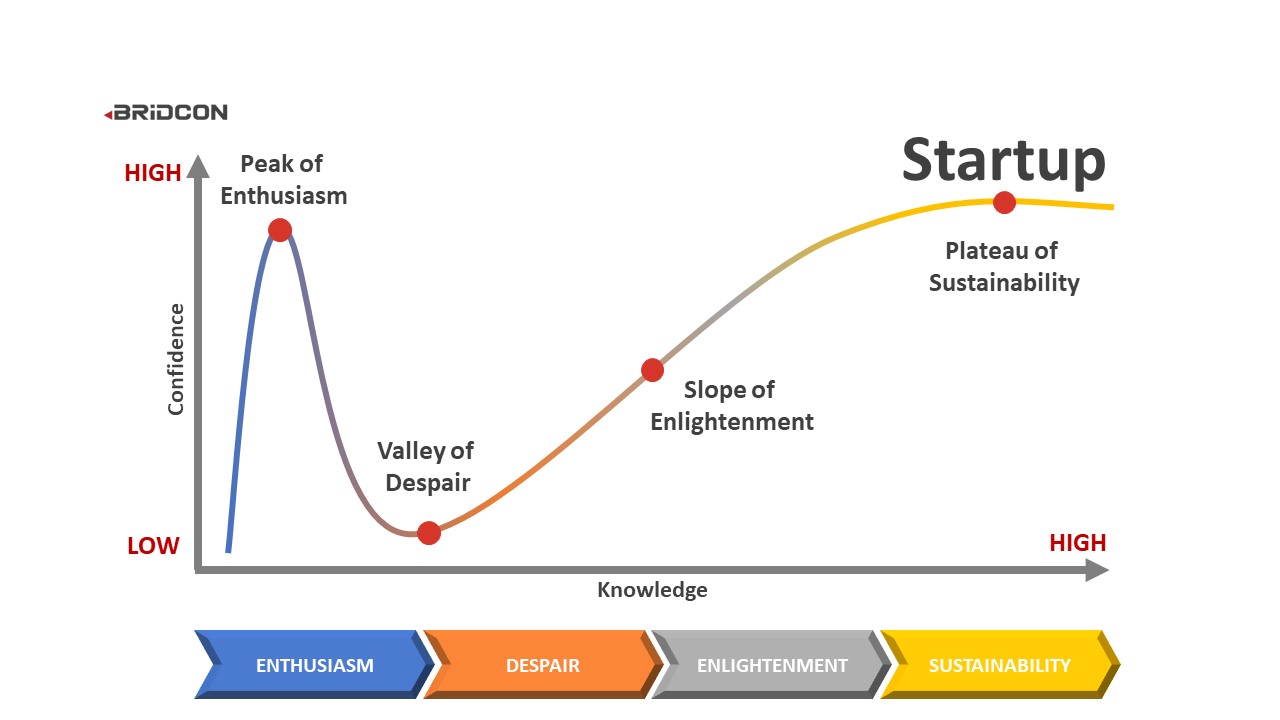

Coined by psychologists David Dunning and Justin Kruger in 1999, the Dunning-Kruger Effect is a cognitive bias where people with low ability or knowledge in a particular area overestimate their competence. In simpler terms: the less you know, the more you think you know or assume.

This phenomenon is especially rampant in environments where information is abundant but not always accurate, a description that fits the crypto industry like a glove. In a world where complex technologies like zero-knowledge proofs, smart contracts, and Layer 2 scaling solutions are discussed side by side with meme coins and TikTok tutorials, the line between expertise and misinformation often blurs and this leads to the rise of “Experts” in the field who typically on their own, would not have been that much of an issue, but when you tend to have these people advise others on financial matters especially concerning volatile niches like crypto, could lead to a rabbit hole of bad decisions.

Confidence is so highly prized that many people would rather pretend to be smart or skilled than risk looking inadequate and losing face.

Even smart people can be affected by the Dunning-Kruger effect because having intelligence isn’t the same thing as learning and developing a specific skill. Many individuals mistakenly believe that their experience and skills in one particular area are transferable to another.

There are so many people who would describe themselves as above average in intelligence, humour, and a variety of skills. Still, they can’t accurately judge their own competence, mainly because they lack metacognition-the ability to step back and examine oneself objectively. In fact, those who are the least skilled are also the most likely to overestimate their abilities. This also relates to their ability to judge how well they are doing their work, hobbies, etc.

Crypto Investing and the Illusion of Knowledge

The barrier to entry into crypto investing is very low, and for want of a better word, anyone with an internet connection and a few dollars can get started. On one hand, this democratizes finance; on the other, it opens the door to a sea of retail traders who may lack even a basic understanding of market dynamics.

And yet, in crypto circles, confidence often trumps competence because sometimes you find that a person who just learned what “staking” means yesterday might start offering investment advice today, and even worse, when they gather enough influence to be referred to as thought leaders on the subject. Telegram groups are full of “experts” who’ve never read a whitepaper, and NFT shills who equate price with value.

This is the Dunning-Kruger Effect in action: overconfidence paired with inexperience, creating a dangerous cocktail of risk misjudgment.

The Role of Social Media and Influencers

Platforms like Twitter and YouTube play a huge role in this dynamic because you tend to find influencers present complex market analyses with the ease of weather forecasts, often speaking in absolute terms about coins that “will 10x” or “are going to the moon.”

Their followers, usually newcomers, absorb this certainty and replicate it. The result is an echo chamber, where misinformation gets amplified and bad advice spreads like wildfire.

In this environment, decision-making becomes less about analysis and more about imitation.

Jane, for example, wasn’t driven by a deep dive into tokenomics or market cycles but by the ever-so-prevalent FOMO—Fear Of Missing Out—a psychological driver that thrives in the absence of knowledge. But by the time the market turned and her investment was cut in half, the influencer had moved on to the next coin.

READ ALSO: FOMO vs FUD: Behavioural Patterns Driving Crypto Volatility

Why the Dunning-Kruger Effect Persists in Crypto

Part of the reason this bias thrives in crypto is that the rewards for overconfidence can be immediate. You can have a novice get lucky with a meme coin and double their money overnight, reinforcing the illusion of skill that then inflates their self-perception. However, when the market crashes, as it always eventually does, the learning comes hard and fast.

It’s like giving someone their first guitar and having them win a talent show by sheer coincidence. What incentive do they have to take lessons after that? Even worse is the possibility of them opening a guitar school and writing lengthy LinkedIn posts touting their opinions as the next best thing since sliced bread.

In traditional finance, guardrails like accredited investor requirements, fiduciary advisors, and regulatory disclosures can slow people down. In crypto, none of these exist in the same way. It’s a jungle—and those who roar the loudest, often without the facts, are the ones who get heard.

Retail Traders and the Cycle of Confidence

Retail traders primarily drive the crypto market – individuals like Jane who act independently, often with limited research. These traders are most vulnerable to the Dunning-Kruger Effect, especially during bull markets when everything seems to be going up.

They make decisions based on gut feelings, YouTube clips, or Reddit hype threads, and while some may stumble into profits, many fall victim to pump-and-dump schemes, scam tokens, or simply poor risk misjudgment.

Worse, when losses come, they’re often attributed to bad luck rather than a lack of understanding, with this externalization of failure preventing learning and perpetuating the cycle.

The Real Cost of Overconfidence

There is a quiet tragedy in this, and that is, behind every viral tweet about massive gains, there are countless stories like Jane’s: people who entered with dreams of freedom and ended up with their wallets emptied by volatility. Overconfidence doesn’t just lead to financial losses; it erodes trust in the system and feeds disillusionment. People who feel duped or misled often exit the space entirely, taking with them not only their money but also their belief in what blockchain technology could have meant for them.

So what’s the cure for the Dunning-Kruger Effect in crypto? Unfortunately, the answer isn’t simple. You can’t stop people from believing they’re smarter than they are, but you can create environments that encourage humility, education, and accountability.

Projects and exchanges could do more to educate users, offering required tutorials before trading or displaying volatility warnings on speculative assets. Influencers could disclose their holdings and risks. Communities could reward curiosity and caution as much as they reward conviction.

Most importantly, we—users, traders, investors—can choose to slow down. To read more. To question more. To ask, “Do I really understand what I’m doing?”

Because in crypto, as in life, the bravest words are often, “I don’t know. Let me learn.”

The Bottom Line

The story of crypto investing is still being written. It’s a story filled with promise and peril, innovation and illusion, and the Dunning-Kruger Effect – this quiet, invisible force still plays a starring role in shaping the experiences of millions.

By recognizing this cognitive bias, we arm ourselves not with cynicism but with caution. We acknowledge that our greatest risk isn’t just the market crashing but the thinking that we’re immune to it because we watched a few videos or made a lucky trade.

In the end, the cure is not certainty, but curiosity, and perhaps that’s the most valuable investment we can make.

Disclaimer: This piece is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

The post The Dunning-Kruger Effect in Crypto: A Story of Confidence and Consequences appeared first on DeFi Planet.