Popular lawyer Bill Morgan has revealed another company that is holding a significant amount of XRP on its balance sheet. This follows the emergence of Evernorth, another treasury company that has accumulated over $1 billion worth of the token.

Another XRP Treasury Company Emerges With Significant Holdings

In an X post, Morgan drew attention to an SEC filing from Virtu Financial that showed it holds XRP on its balance sheet. The company, which boasts a market cap of just over $5 billion, holds 22 million XRP worth just over $55 million at the current price. The lawyer also noted that the company appears to be financially strong, which is a positive for the altcoin.

Related Reading: Are The XRP Tokens In Escrow At Risk Of Being Sold? Ripple CTO Shares Insights

The treasury company is said to be a global financial services firm specializing in market-making and execution services. Furthermore, the company provides liquidity across global markets in asset classes including equities, ETFs, fixed income, commodities, and derivatives.

Based on data from Crypto Treasury Tracker, Very ranks among the top 10 largest XRP treasury companies, just behind Wellgistics Health. It is worth mentioning that Virtu has underperformed this year despite its holdings. TradingView data shows that the company’s stock is down over 2% year-to-date (YTD). However, the stock has risen by over 3% in the last five days.

Meanwhile, this development follows the recent emergence of Ripple-backed Evernorth, which plans to build the largest treasury. XRPScan data shows that the treasury company currently holds 388.7 million XRP worth nearly $1 billion, making it the largest XRP treasury. The company had earlier announced plans to raise over $1 billion from investors such as Ripple, Kraken, Pantera Capital, and GSR.

This comes ahead of the company’s debut on the Nasdaq. The treasury company plans to list on the stock exchange through a business combination agreement with Armada II. Armada notably recently changed its ticker to XRPN as part of the business agreement.

More Institutions Set To Accumulate The Altcoin

More institutional investors are set to accumulate the token with the imminent launch of the Canary Capital XRP ETF. The asset manager filed an amendment to its fund to remove the delaying amendment, allowing it to launch on November 13. This will be similar to how the firm launched its Hedera and Litecoin ETFs earlier this week.

Related Reading: The Deadline For The Ripple Bank Is Almost Here – Important Date draws Close

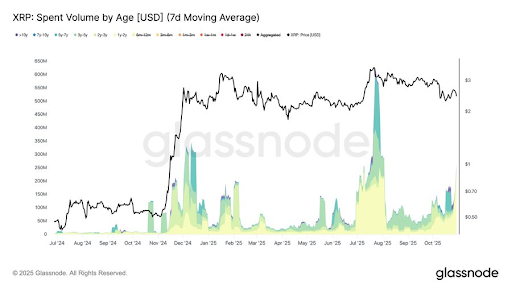

However, while institutions look to accumulate the token, long-term holders are offloading their coins, which is negatively impacting its price. On-chain analytics platform Glassnode revealed that these holders who accumulated before November 2024 have ramped up their spending by 580% from $38 million daily to $260 million daily. The platform noted that this is a clear sign that seasoned traders are exiting and adding pressure to the price action.

At the time of writing, the altcoin’s price is trading at around $2.51, up over 2% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Freepik, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.