According to the latest data from BitcoinTreasuries, the total amount of Bitcoin (BTC) held by public firms recently surpassed the one million mark, underscoring the rapid pace of adoption of the digital asset worldwide.

Bitcoin Adoption Shows No Signs Of Slowing

While corporate adoption of Bitcoin is not a novel practice, the trend gained significant momentum following US President Donald Trump’s victory in the November 2024 elections. Since then, several firms have unveiled BTC corporate treasury strategies.

Michael Saylor-led Strategy – formerly MicroStrategy – continues to be the undisputed leader of the trend, having some 636,000 BTC on its balance sheet at the time of writing. However, other companies like Metaplanet, Semler Scientific, and MARA Holdings have been busy increasing their BTC exposure over the past ten months.

Commenting on the development, BitcoinTreasuries President Pete Rizzo said that despite the total amount of BTC crossing one million, multiple indicators still show that institutional adoption of the digital asset is still in its infancy.

Rizzo referred to the fact that most companies have only recently started to accumulate BTC for the long haul. As a result, a major chunk of the capital raised by such firms remains yet to be deployed for BTC purchases.

Bradley Duke, Head of Europe at Bitwise, commented on the milestone saying that the total value of BTC locked in corporate treasuries is now worth more than $111 billion. He added:

The structural imbalance between BTC supply and demand is real and getting more pronounced.

Data from BitcoinTreasuries shows that currently, more than 100 companies hold BTC on their balance sheets. However, if recent developments are to go by, the corporate adoption of digital assets does not seem to be limited to BTC.

Recently, a number of companies have announced plans to adopt Ethereum (ETH) as part of their corporate treasury strategy. While ETH does not have a hard supply cap of 21 million like BTC, it does offer multiple use-cases and the Proof-of-Stake (PoS) consensus mechanism which helps in reducing the active circulating supply of ETH.

Will Companies Pivot To ETH?

At present, BTC commands a total market cap of over $2 trillion, compared to Ethereum’s $518 billion market cap. Although there’s still a difference of almost $1.5 trillion, ETH is quickly closing in the gap.

For instance, asset manager VanEck CEO, Jan van Eck, recently called ETH the “Wall Street token,” saying that Ethereum’s role in facilitating stablecoin transactions will likely help it give strong competition to BTC.

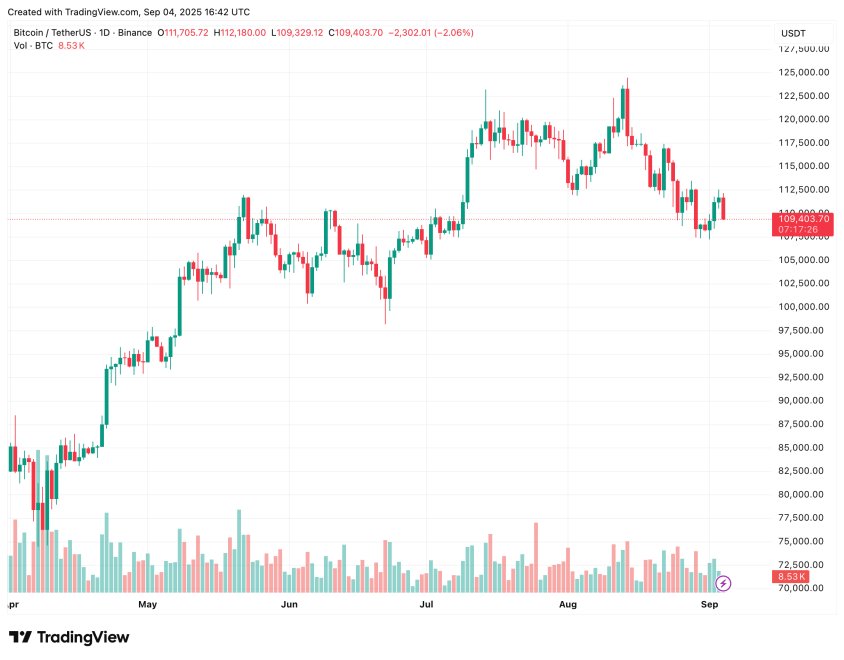

Recent exchange-traded funds (ETF) data also supports the quiet institutional rotation from BTC to ETH, as ETH ETFs saw almost $4 billion in inflows during August 2025. At press time, BTC trades at $109,403, down 2.2% in the past 24 hours.

Featured image from Unsplash.com, chart from and TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

![[LIVE] Crypto News Today, September 5 – Bitcoin Price Surges Past $112K as Altcoins Lag Behind: Best Crypto to Buy? [LIVE] Crypto News Today, September 5 – Bitcoin Price Surges Past $112K as Altcoins Lag Behind: Best Crypto to Buy?](https://news.cryptowaffle.fun/wp-content/themes/jnews/assets/img/jeg-empty.png)