In a notable trend this year, crypto-focused companies are increasingly seeking to go public. The latest entrant to this wave is a newly established Bitcoin treasury firm backed by Tyler and Cameron Winklevoss, which is preparing for a public listing in Amsterdam.

Treasury Plans Amsterdam Debut

According to a report by Reuters, the Netherlands-based firm, named Treasury, has announced plans to list on the Amsterdam stock exchange through a reverse merger with Dutch investment firm MKB Nedsense. This move is said to allow Treasury to access public markets more quickly and efficiently.

The company recently raised €126 million (approximately $147 million) in a private funding round led by Winklevoss Capital and Nakamoto Holdings, indicating strong backing from notable investors.

The reverse listing is expected to provide a significant premium, reflecting a 72% increase over MKBN’s closing share price of €0.7 as of July 11. Both companies aim to achieve a post-consolidation share price of €2.10.

To finalize this process, MKBN will hold an extraordinary shareholders meeting to approve the transaction. Following the successful completion, MKBN will be rebranded as “Treasury N.V.” and will trade under the ticker symbol “TRSR.”

This move follows a broader trend in the Dutch market, where local crypto firm Amdax announced its plans in August to launch a Bitcoin treasury company named AMBTS on Euronext Amsterdam.

Bitcoin treasury companies, like Treasury, hold Bitcoin reserves as their primary assets, differentiating them from traditional firms that typically hold cash. This model allows them to focus on accumulating and retaining Bitcoin over the long term.

A prominent example of this strategy is Michael Saylor’s company, Strategy (formerly MicroStrategy), which has continually added to its Bitcoin holdings on weekly basis, resulting in significant unrealized profits for the company so far.

Treasury has already amassed over 1,000 Bitcoin, which pales in comparison to Strategy’s stash of 636,000 Bitcoin, according to BitcoinTreasuries.net data. However, it is positioning itself to attract investors in a region where crypto options are relatively limited compared to those in the United States.

Gemini’s Upcoming IPO

In addition to their new venture, the Winklevoss twins are also preparing crypto exchange Gemini for an initial public offering (IPO) in the US.

As reported by Bitcoinist on Tuesday, they are targeting a valuation of up to $2.22 billion, with plans to offer 16.67 million shares priced between $17 and $19 each under the ticker “GEMI.”

If successful, this IPO could raise approximately $317 million at the upper end of the pricing range, making Gemini the third publicly traded digital asset exchange, following the successful launches of Bullish and Coinbase.

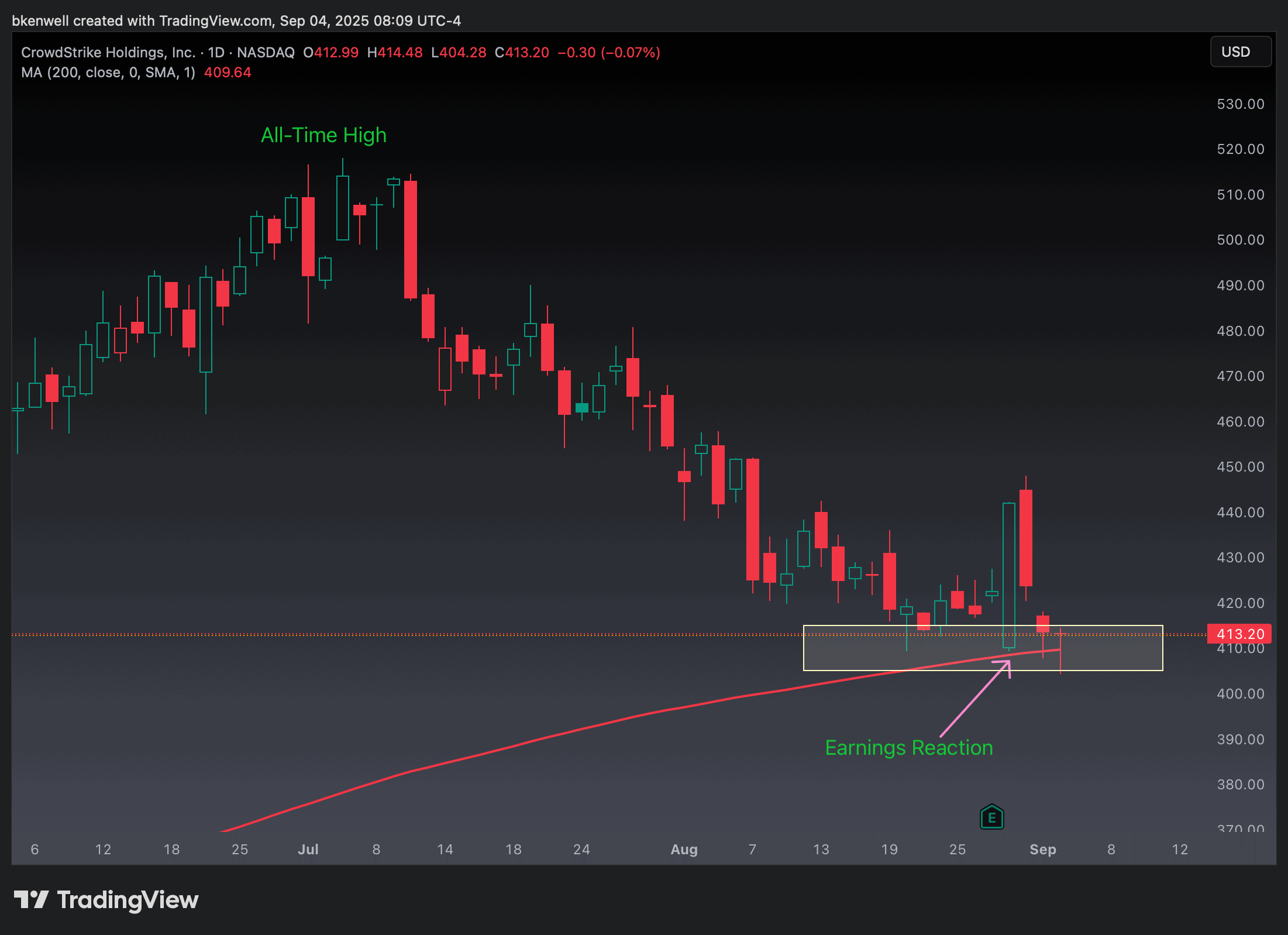

Featured image from DALL-E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.