Ethereum (ETH) remains under pressure, trading below the $4,000 mark as bulls attempt to reclaim control following weeks of post-crash uncertainty. The sharp sell-off on October 10 not only flushed leveraged positions across the market but also disrupted the uptrend ETH had been building throughout the summer.

Since then, price action has weakened, and momentum has shifted toward the downside, raising concerns among analysts that a deeper correction could unfold if buyers fail to defend key demand levels in the days ahead.

Related Reading

Despite these technical challenges, on-chain and institutional flow data tell a different story beneath the surface. Large-scale investors — including funds, corporate entities, and crypto-native institutions — continue to accumulate ETH during the pullback.

The divergence between price weakness and institutional accumulation creates a pivotal setup for Ethereum. If ETH can stabilize and reclaim the $4,000 threshold, it may re-ignite bullish momentum. But failure to hold support could open the door to further downside before a sustainable recovery emerges.

Bitmine Adds ETH as Institutional Accumulation Climbs

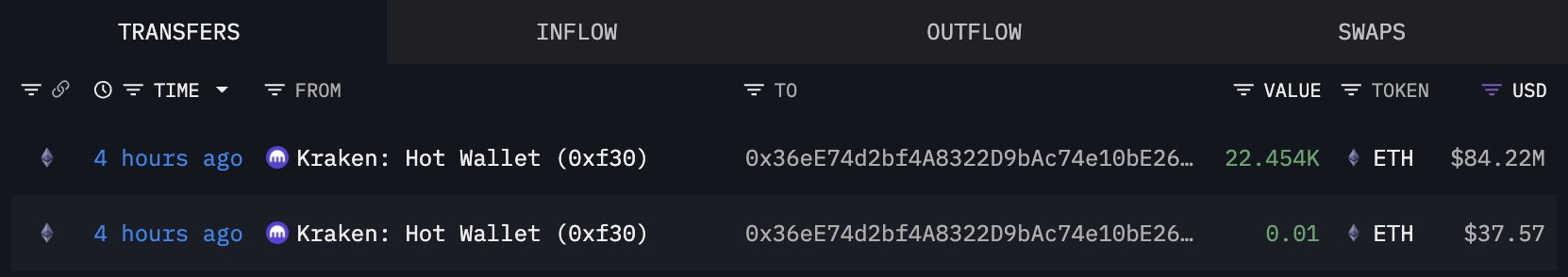

According to data tracked by Lookonchain, institutional player Bitmine has continued its aggressive accumulation strategy. Purchasing 44,036 ETH — worth approximately $166 million — during the recent market pullback.

This purchase lifts Bitmine’s total holdings to roughly 3.16 million ETH, valued at around $12.15 billion, reinforcing the company’s position as one of the largest Ethereum holders globally. Such sizeable buying activity during periods of price weakness highlights a notable divergence between institutional behavior and short-term market sentiment.

While retail traders and leveraged participants may be shaken by Ethereum’s inability to reclaim the $4,000 level, long-horizon buyers appear unfazed. For them, price dips represent accumulating opportunities rather than reasons for concern.

This duality is becoming increasingly evident across the market: spot inflows, exchange outflows, and whale accumulation metrics all point to growing long-term conviction, even as the chart reflects hesitation and downward pressure.

This divergence underscores a familiar pattern in crypto market structure. Price action often lags underlying fundamentals, particularly during transitional phases where macro catalysts and liquidity shifts are still being digested. Ethereum remains structurally supported by rising institutional participation, increasing staking demand, and expanding Layer-2 ecosystems — all of which strengthen its long-term investment thesis.

Related Reading

Ethereum Tests Key Support

Ethereum (ETH) is trading around $3,847, testing a critical support zone after failing to hold above $4,000 and rejecting from the $4,200 resistance area earlier this week.

The daily chart shows ETH breaking below both the 50-day (blue) and 100-day (green) moving averages, signaling weakening momentum and a shift toward a more defensive market posture. This breakdown places increased pressure on bulls to defend the $3,800 region — a level that has repeatedly acted as a pivot point over the past two months.

If ETH loses this support, the next meaningful demand zone lies near $3,500, followed by the 200-day moving average around $3,200, which would serve as a deeper structural retest within the longer-term uptrend. For now, however, ETH remains above its long-term trend line, meaning the broader bullish structure is intact despite short-term weakness.

Related Reading

On the upside, bulls need to reclaim $4,000 and then $4,150–$4,200 to revive bullish momentum and break the series of lower highs forming since September. Until that happens, price action favors consolidation and caution. With macro shifts underway and institutional accumulation rising, Ethereum’s chart suggests a wait-and-see phase, where holding support becomes crucial before any renewed upside attempt.

Featured image from ChatGPT, chart from TradingView.com