Legendary cyberpunk Nick Szabo and Ryan Watkins, co-founder of Syncracy Capital, laid out opposing frameworks for understanding Ethereum’s rally and its valuation mechanics in a pair of X posts — and together they read like a point-counterpoint on what actually drives Layer-1 prices.

Ethereum Price Has Nothing to Do With Utility

Szabo’s core claim is stark: “a fundamental problem with ETH valuation is that ethereum’s primary uses cases are largely external to ETH’s market value.” In his view, Ethereum “can be very useful,” its applications “can garner great revenue,” and yet “ETH can still be low price — or vice versa — there is little link between them.”

He contrasts this with Bitcoin, whose “main use case is as a store of value, which is strongly linked to its price,” adding that “Bitcoin’s basic design is far more suited to this use case, so ETH can’t just mimic it, it has to rely on other use cases poorly linked to its price.” For Szabo, the crux is structural: utility on Ethereum does not reliably translate into value capture by ETH, whereas Bitcoin’s purpose and price are entwined by design.

Szabo’s statement, who returned to X in late September 2025 after a five-year absence, came in response to a by Watkins. The researcher comes at the market from the opposite angle, arguing that investors routinely over-engineer Layer-1 valuation models while price and narrative do the heavy lifting. “Time and again I see people overthink L1 valuations,” he wrote, framing the last leg of ETH strength as a narrative pivot rather than a spreadsheet breakthrough.

Why Has ETH Price Tripled Since April?

“The only difference between $1400 ETH and $5000 ETH was Bitmine.” In April, he says, “Ethereum was a dying platform.” Today, “it’s the stablecoin chain and the next ‘Bitcoin-like’ opportunity for institutions.” The lesson he draws is blunt: “Price leads narratives so they say.”

Crucially, Watkins is not insisting these narratives are justified — he’s highlighting the vacuum they fill. “The point here isn’t about whether any of this is justified. The point is that the absence of agreed upon valuation methodologies creates a void that only narratives and relative frameworks can fill.”

He floats competing bull cases not as convictions but as open hypotheses: “Is the ETH bull case that it becomes a take rate on global GDP? What about it becoming ‘programmable Bitcoin’ which intrinsically can’t be valued? How about both? The truth is no one knows.”

That uncertainty, he says, pushes markets toward anchoring on simple comparisons and flows: “So what happens when the market instead anchors to relative value and narratives? Well BTC is $2 trillion. So who’s to say ETH shouldn’t be 50% of that? It offers a superset of Bitcoin’s functionality right? ETH is $500B. Why shouldn’t SOL be 100% or more of that? It’s the superior product with greater traction across almost every economic metric.”

He dismisses these as “goofy” exercises, but useful for navigation: “we can theorize all we want, or navigate the environment in front of us.” Until fundamentals reassert, “don’t overthink it.” In his closing line, he defines the edge plainly: “There’s an enormous competitive advantage for assets that have penetrated mainstream consciousness and persisted over time. It’s a game of flows and narratives until the party stops.”

Both views can be true at once. Markets may continue to price ETH primarily through narratives and relative value while the question Szabo poses — whether Ethereum’s design can ever hard-wire a durable link between network utility and token value — remains unanswered. For now, the debate itself is the signal: ETH is moving through a cycle where perceptions of purpose, not just measurable cash-flow analogs, set the tone.

At press time, ETH traded at $4,701.92.

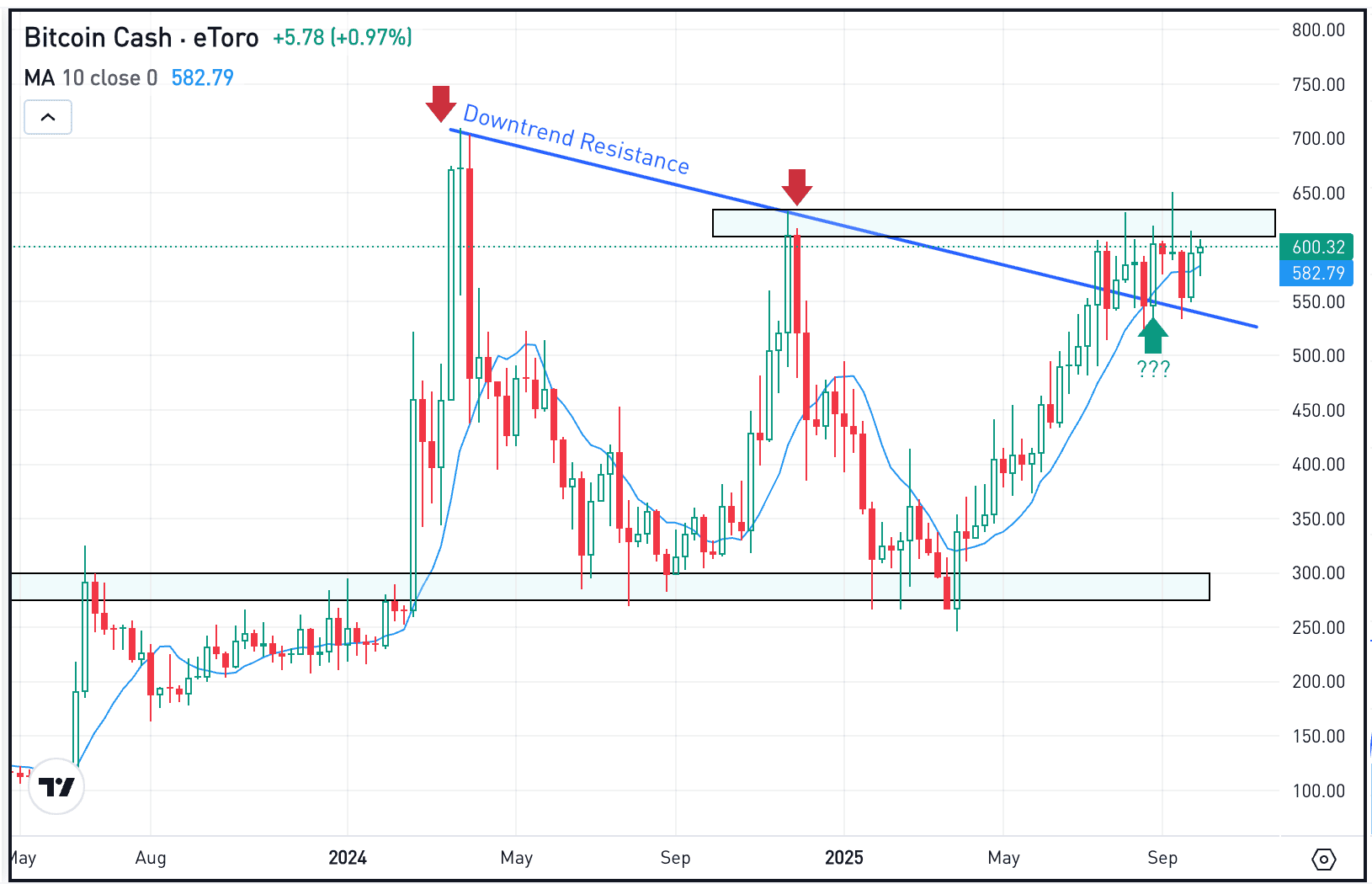

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.