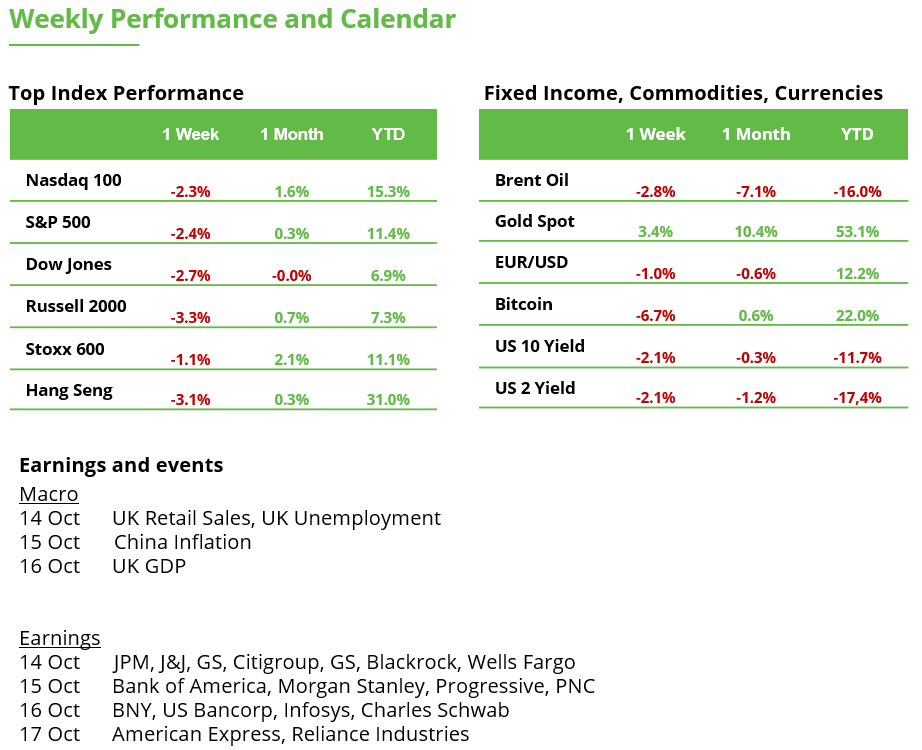

Analyst Weekly, October 13, 2025

China Tensions Rising Again

What Happened: Beijing expanded export restrictions on rare-earth materials critical to AI and semiconductor production, launched an antitrust probe into Qualcomm, and introduced new port fees ahead of US measures on large Chinese vessels (effective Oct. 14). In response, the US President threatened tariffs of up to 100% on Chinese imports and signaled additional export controls on sensitive technologies.

Investment Takeaway: In our view, recent actions point to renewed friction rather than collapse in the US–China trade dialogue. While high tariffs could ultimately weigh on tariff revenues and holiday-season supply, both governments appear focused on strategic positioning rather than outright disengagement. Additional measures on plastics, chips, and potentially energy-linked trade (China’s oil dealings with Russia) could follow.

Short term: Rising policy uncertainty may keep export-heavy and China-exposed sectors under pressure (hardware, autos, shipping).

Medium term: US quality and domestically oriented equities remain better positioned amid a more self-sufficient industrial policy.

Long term: Industrial self-sufficiency, semiconductor independence, and supply-chain resilience remain central themes.

Policy-driven Industrial Revival

Washington’s “sovereign wealth” like investments, targeting US Steel, Intel, MP Materials, Lithium Americas, and Trilogy Metals, signal a structural pivot toward domestic production of critical materials and chips.

Investment Takeaway: Long-duration support for US metals, rare-earth, and semiconductor supply-chain names as these firms become central to national security-linked production. Companies impacted:

US Steel (X) – steel capacity and reshoring narrative.

MP Materials (MP), Lithium Americas (LAC), Trilogy Metals (TMET) – critical minerals, rare earths, and EV-supply inputs.

Intel (INTC) – CHIPS Act capital infusion and geopolitical preference over Asia-based peers.

Earnings Preview: Major S&P 500 Companies Reporting October 13–17, 2025

The week of October 13, 2025 marks a key kickoff to the third-quarter 2025 earnings season. A slew of major US companies, spanning banking, healthcare, consumer, and industrial sectors, are set to report results. Investors will be dissecting these reports for clues on economic health and company-specific trends.

JPMorgan Chase & Co. (JPM): A “rebound in investment banking” is expected to lift earnings. Investors will focus on net interest income (NII) which has been boosted by higher interest rates and whether management raises its full-year NII guidance after strong gains

Wells Fargo & Co. (WFC): Investors will look for any change to NII guidance given rate moves and deposit trends in Q3. The street will focus on any commentary on reducing expense levels.

The Goldman Sachs Group (GS): Goldman’s backlog of deals and commentary on the M&A outlook will be key; investors want to know if the Q3 surge is sustainable or “one-off.”

BlackRock Inc. (BLK): Fund flows are the lifeblood of BlackRock’s growth. Any commentary on investor preferences (e.g. moving into bond funds given higher yields) will be valuable.

Citigroup Inc. (C): Citi’s multi-year revamp means it is incurring charges to streamline management layers and divest certain units. Investors are laser-focused on expense control: will the Q3 results show efficiency improving?

Bank of America Corp. (BAC): Like peers, BofA faces inflationary pressures on costs (wages, tech spend). Any mention of efficiency improvements or areas of cost discipline (e.g. branch network optimization) will be welcomed.

PNC Financial Services (PNC): Regional banks in 2025 have faced pressure from customers reallocating deposits to higher-yielding options (so-called “deposit beta” pressure). Investors will watch how PNC’s deposit balances and costs fared in Q3. Credit quality is another focus.

Johnson & Johnson (JNJ): Investors will focus on management’s commentary around the company’s pharmaceutical pipeline momentum and on sustained MedTech growth.

Progressive Corp. (PGR): Insurer likely to indicate that it will maintain pricing discipline even after gaining over a point of auto insurance market share, and will closely monitor claims cost trends (like auto repair inflation and catastrophe losses) to sustain its superior underwriting performance.

United Airlines (UAL): Investors will be tuned into the carrier’s cost guidance; United expects a tailwind from lower fuel prices helping Q3 results.

American Express (AXP): Investors will focus on whether American Express can sustain strong premium card spending and loan growth while maintaining credit quality.

Crypto Got Crunched

Last Friday, crypto faced one of its ugliest hours ever. Bitcoin plunged 15% in about an hour, Ethereum slid 20%, and some altcoins got halved. A record-breaking liquidation event that saw nearly $20 billion in leveraged positions wiped out in just one day.

What sparked it:

Tariff tensions between the US and China lit the fuse, but the explosion came from within. The market was over-leveraged and paper-thin on liquidity.

How it unraveled:

Perpetual contracts, the go-to weapon for traders, became the trigger. As leveraged longs got liquidated, automated sell orders snowballed, wiping out over half of global open interest in under two hours.

The big picture:

It’s noteworthy that despite the scale of the event, Bitcoin has already recovered to around $115K on Sunday, reflecting its increasing resilience and market maturity.

Takeaway for investors:

Steer clear of instruments without real depth.

Prefer direct, transparent, and custodied exposure.

Treat crypto as infrastructure, not a quick gamble.

SPDR S&P Bank ETF Defends Short-term Support Zone

The SPDR S&P Bank ETF slipped by nearly 1% last week, extending its losing streak to a third consecutive week. However, the bulls managed to defend the fair value gap between 56.41 and 57.36, a zone that emerged from the sharp rally in August and now serves as a key support area.

As long as this range is not sustainably broken to the downside, the uptrend structure, characterized by higher highs and higher lows in recent months, remains intact. From a technical perspective, this suggests that a continuation of the trend is the most likely scenario.

For the uptrend to resume, however, buyers will need to overcome the fair value gap between 60.93 and 61.38, an important resistance zone where the ETF has already failed several times. The upcoming earnings season will likely determine whether a new breakout attempt is on the horizon or if the support zone will be tested again.

SPDR S&P Bank ETF, weekly chart. Source: eToro

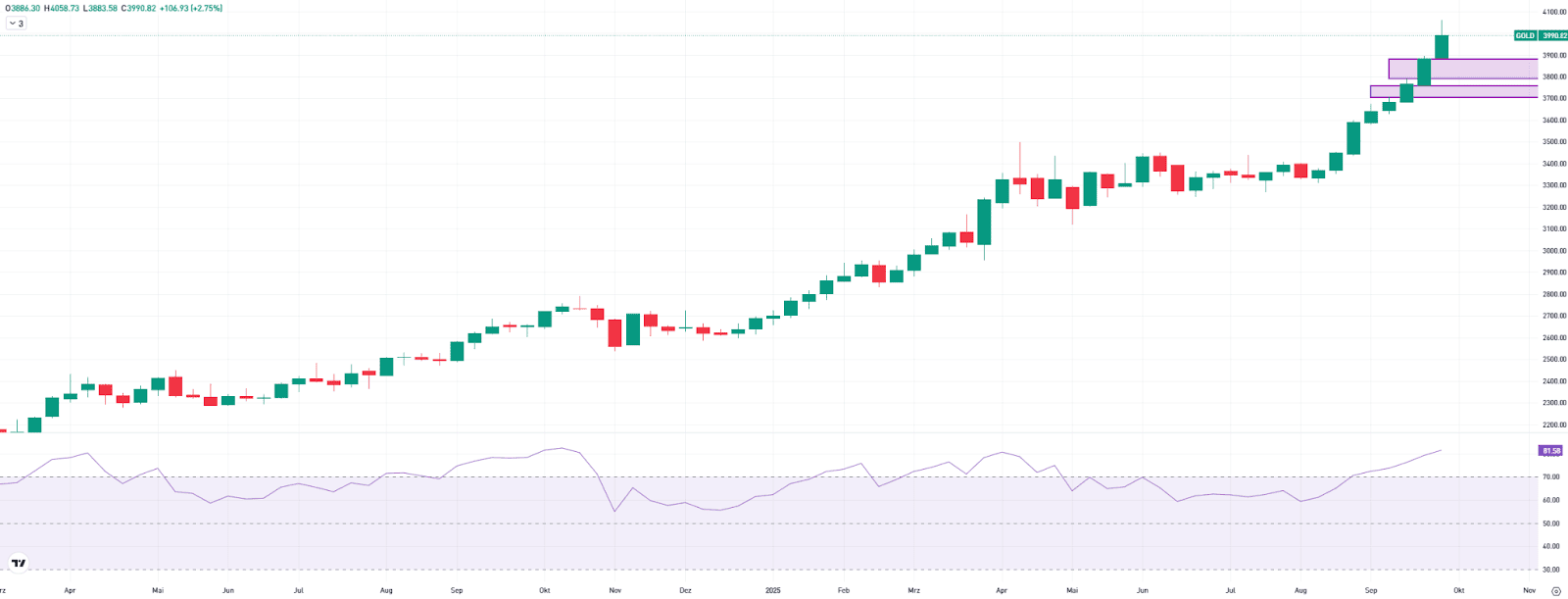

Gold: Record High and Overheating at the Same Time?

Gold rose by 2.75% last week, marking a new all-time high. At one point, the price even climbed above $4,000, leaving little doubt about the strength of the uptrend.

However, the short-term upward impulse now appears to be greatly overstretched. It was already the eighth consecutive week of gains, and the RSI, at over 81, is flashing clear signs of overheating. Since the beginning of the year, gold has gained more than 50%.

An overbought market doesn’t necessarily mean that a correction is imminent. Still, a pullback would be healthy to ease the overheated situation. Such consolidation phases can last for several weeks and are often accompanied by the RSI dropping back below the 70 level.

The first key support zones are the fair value gaps between $3,790 and $3,883 as well as $3,707 and $3,762. Investors should closely monitor how the price behaves in these areas if the gold price experiences a short-term pullback.

Gold, weekly chart. Source: eToro

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.