Ripple’s RLUSD could benefit from the new rules and expand its use in US financial systems.

Only 14 million XRP tokens have been burned to date versus 59.1 billion in circulation.

The pending CLARITY Act could further clarify XRP’s legal status in the US market.

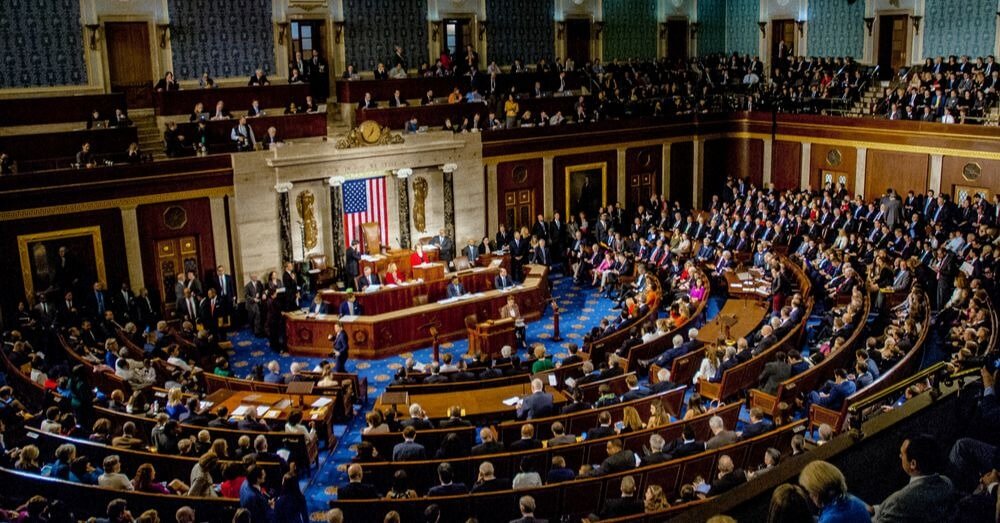

Ripple’s strategic position in the evolving US stablecoin landscape received a boost last Friday after President Donald Trump signed the “Guiding and Enabling the Nationwide Innovation of US Stablecoins” (GENIUS) Act into law.

The legislation establishes a formal regulatory path for stablecoin issuers and paves the way for institutions to adopt digital dollars under federal oversight.

For Ripple, this offers new ground to promote its RLUSD stablecoin—but has limited bearing on its native XRP token.

GENIUS Act offers regulatory clarity for Ripple’s RLUSD

The GENIUS Act provides a legal framework for dollar-backed stablecoins, enabling issuers to operate under federal charters and meet specific reserve and audit standards.

The move benefits stablecoins such as USDC, PayPal USD, and RLUSD, all of which aim to be integrated into institutional finance and payment systems.

Ripple’s RLUSD, though not yet as widely adopted as rivals like Circle’s USDC or Tether’s USDT, could leverage the act’s legal clarity to position itself as a compliant, regulated stablecoin within the United States.

Unlike decentralised or offshore stablecoins, RLUSD could function as a native liquidity provider for on-shore financial transactions, potentially giving Ripple a role akin to a financial infrastructure provider in the regulated US market.

While RLUSD stands to gain traction from the GENIUS Act, this advancement is unlikely to bring meaningful price movement to XRP. The two are functionally separate, with XRP continuing to serve as a bridge token on the XRP Ledger.

XRP supply dynamics unaffected by RLUSD transactions

Although RLUSD will operate on the XRP Ledger and every transaction will burn a small amount of XRP to pay network fees, the volume is too low to materially affect the coin’s price or supply.

Since inception, only 14 million XRP tokens have been burned, while the circulating supply remains over 59.1 billion. This shows that even under heavy usage, token burns through stablecoin transactions will not significantly influence XRP’s deflation rate or valuation.

Ripple’s Chief Technology Officer, David Schwartz, has previously downplayed the impact of such burns, noting that they will not materially reduce supply in the foreseeable future.

This reinforces the view that RLUSD-related network activity will not shift XRP’s price dynamics in a meaningful way.

Ongoing SEC lawsuit adds uncertainty to XRP classification

The broader regulatory environment for XRP remains unresolved, as Ripple’s legal battle with the US Securities and Exchange Commission (SEC) continues.

A previous ruling determined that XRP is not a security when sold on public exchanges but may be classified as one in institutional placements. This duality in classification introduces lingering uncertainty about XRP’s long-term regulatory status.

The current ambiguity impacts Ripple’s ability to rely solely on XRP within the US. In this context, the GENIUS Act gives Ripple a compliant alternative in RLUSD, reducing regulatory exposure in XRP-heavy transactions.

This shift enables the company to broaden its reach in regulated financial environments while maintaining its core blockchain infrastructure.

CLARITY Act could redefine XRP’s regulatory standing

Looking ahead, further legislative developments could reshape Ripple’s token strategy. The pending CLARITY Act proposes a formal path for digital assets to transition from securities to commodities over time.

If passed, it could eliminate the regulatory ambiguity surrounding XRP’s classification and facilitate broader tokenisation strategies involving Ripple’s ecosystem.

In the meantime, RLUSD provides a way for Ripple to participate in the stablecoin market without depending on XRP in uncertain regulatory conditions.

This dual-token strategy offers flexibility, allowing Ripple to align with evolving US regulations while continuing to promote its ledger technology.