For the first time this year, the United States Federal Reserve slashed interest rates to the +4% to +4.25% range. This decision was highly anticipated and came, to some degree, from political pressure. Yet, with falling fund rates, there are high expectations that decentralized money markets, including Aave crypto, will shine. For this reason, the focus has been on AAVE USD.

According to Coingecko, the Aave price is up +126% year-to-date and firm in the past month, adding a decent +7%. Yet, despite the optimism around crypto, with analysts painting bullish projects, including posting solid Aave price prediction posts, AAVE USDT is stable in the last week of trading, adding roughly +1%.

(Source: Coingecko)

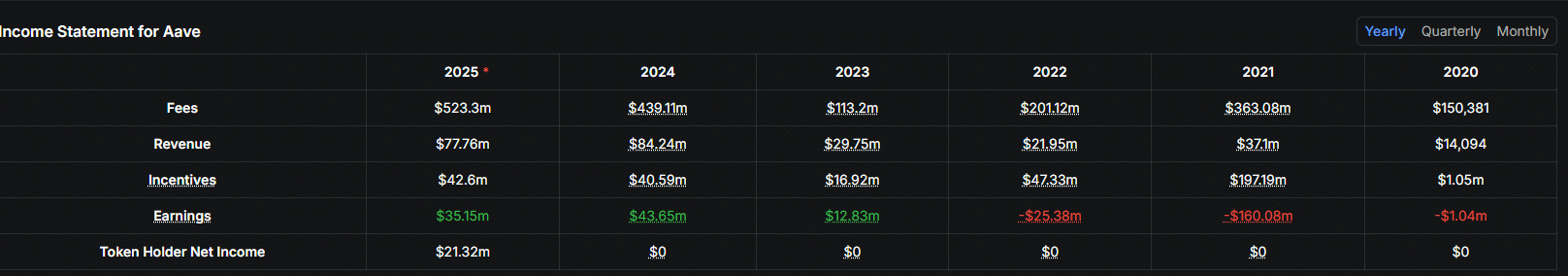

This rather slow price action is when Aave is finding massive adoption. Per DefiLlama, the decentralized money market currently manages over $42Bn. Since 2020, the Aave total value locked (TVL) has been inching higher, translating to higher platform revenue. In 2020, Aave generated just $150,000 in yearly revenue. However, by the end of 2024, this had grown to over $84M.

(Source: DefiLlama)

DISCOVER: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

Federal Reserve Slashes Rates To The +4% to +4.25% Range

This revenue is expected to grow this year. With three more months to go, Aave crypto has generated over $77M in revenue, earning $35M.

Looking at historical trends, the low-interest-rate environment in the United States now creates a favorable environment for crypto platforms. Similar to the last 2020-2021 crypto boom, which was primarily driven by DeFi and NFTs, DeFi protocols will likely attract more capital.

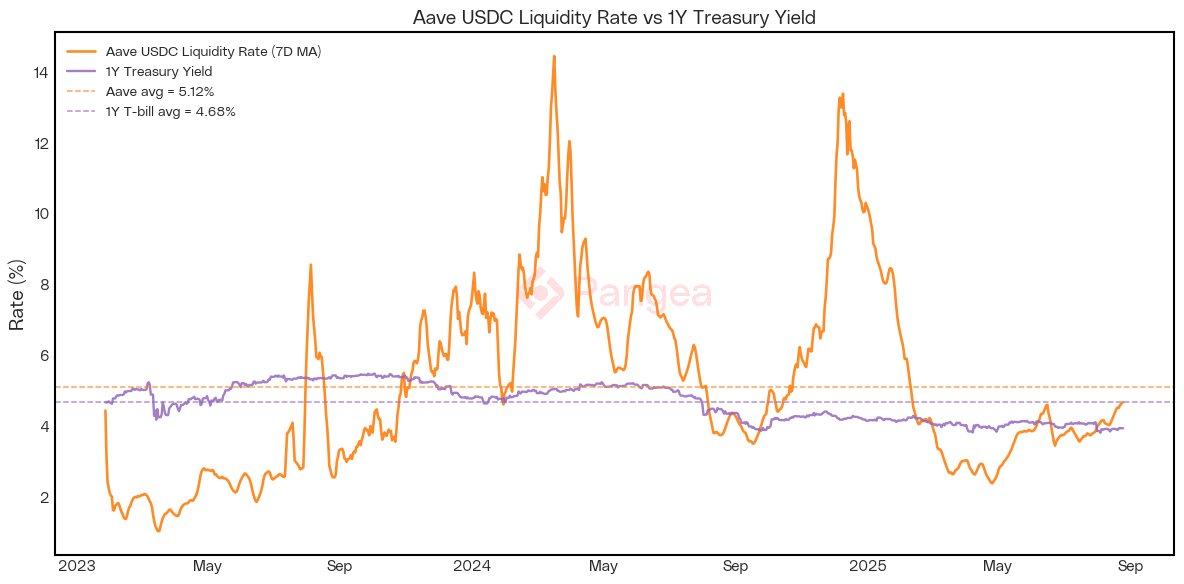

In a post on X, Stani Kulechov, the founder of Aave, boldly claimed that the rate cut now creates what he calls an “arbitrage opportunity” for Aave USD yields. This, he adds, is because they are less correlated with declining traditional USD yields.

Today The Federal Reserve lowered their interest rate by 25 bps. From my perspective this is an increase for the arbitrage opportunity for rates in Aave.

Over the past 5 years Aave has been able to beat the us t-bill rates, offering reliable and uncorrelated yield.

My…

— Stani.eth (@StaniKulechov) September 17, 2025

Currently, the 1-year Treasury bill yields hover around 3.62%. Kulechov predicts that treasury yields will continue declining with more rate cuts scheduled in Q4 2025, possibly to the +3% to +4% range by 2027. This dovish environment will make Aave USD yields, specifically on stablecoins like USDC, more attractive.

Historically, in a low fund rate environment, the USDC liquidity rate on Aave v3 has consistently outperformed Treasury bill yields by an average of +0.44%. Research findings show that the yield further spikes, especially during heightened crypto volatility.

(Source: Pangea)

As an illustration, during the 2021 bull run, when AAVE USD rose to as high as $670, AAVE USD supply rates rose to +10%. During that time, treasury bills yielded almost zero following aggressive rate cuts to contain the effects of the pandemic.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Aave TVL Rising, Will AAVE USD Spike To $400?

With the Federal Reserve now forcing rates lower just when crypto momentum is picking up and more capital is being funneled to DeFi, AAVE USD could be the biggest beneficiary.

AAVE derives its value from protocol usage. The more inflows, the higher the probability of  AAVE ▲4.10% surging. Moreover, with lower rates in TradFi, the yields on DeFi platforms, mostly Aave, are more attractive. As such, more users are likely to supply assets, searching for the high supply rate on Aave.

AAVE ▲4.10% surging. Moreover, with lower rates in TradFi, the yields on DeFi platforms, mostly Aave, are more attractive. As such, more users are likely to supply assets, searching for the high supply rate on Aave.

As leverage and borrow demand rise on Aave, its TVL will increase and so will its utility, pushing AAVE USD towards local resistances. In the short term, the first liquidation level is $400.

Another catalyst supporting AAVE USD is the expected Aave V4, set for Q4 2025. The upgrade introduces a Hub-and-Spoke architecture that could change DeFi liquidity, reduce costs, and boost the AAVE price.

Aave v4 will release a unified liquidity layer that aggregates assets across multiple chains that use Chainlink’s CCIP.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

FOMC Drops Rates, Will AAVE USD Break $400?

FOMC drops fund rates to the 4-4.25% range

Aave crypto TVL is rapidly growing

Aave founder expects more inflow

Will AAVE USD breach $400 in three months?

The post With FOMC Slashing Rates, Will AAVE USD Break $400 By December 2025? appeared first on 99Bitcoins.